Roman Catholic Vicar-General, Kennedy Muguti, says political will is required to ensure that new policy measures to revive the economy announced by the Reserve Bank of Zimbabwe (RBZ) are successful.

Muguti said depositors and captains of industry are skeptical about the new measures that will lead to the introduction of bond notes as they have lost confidence in the government’s economic policies.

In remarks at a discussion organized by the Catholic Bishops’ Social Communications Commission on whether Zimbabwe could be better off without the U.S currency, Muguti said the interventions by the central bank should have been done after consultations with all stakeholders.

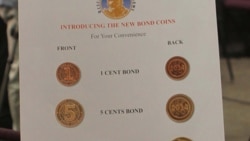

The RBZ announced a raft of measures to revive the economy which include among other issues, daily cash withdrawal limits, the introduction of bond notes and use of plastic money.

But depositors and industry have come out strongly against the measures in particular the introduction of bond notes. Muguti said they have all the reasons to be skeptical about these new measures.

“While the government is making frantic efforts, including you (RBZ governor) to dismiss the fears by the depositors and investors, the situation on the ground shows that the people have lost trust and confidence in the economic policies you are coming up with,” Muguti said.

He said the people’s fears are reasonable given the past experiences where many of them are poorer today as a result of government policies.

“Many are in their poverty state today because they did not recover from that back stab that they experienced and today when you ask them just continue to look forward, no they will look backward because they know that somebody can come back from the back and stab them again. So, this is the reason why people are very careful and also this is the reason why people are saying ‘I would rather go and take out may $500 and keep it with me’,” he said.

But Barclays Zimbabwe managing director, George Guvamatanga, said the interventions by the central bank are welcome given the indiscipline by depositor’s banks and other players.

He said if not properly applied as was happening in Zimbabwe the U.S dollar could be harmful to the economy.

Guvamatanga said putting daily withdrawal limits at $1,000 per day was unrealistic given that the average monthly salary in Zimbabwe was $374.

“I actually think that a weekly withdrawal limit of $500 will be adequate for day to day transacting,” said Guvamatanga.

Guvamatanga admitted that the cost of using plastic money and Real Time Gross Settlement or RTGS was too high.

He urged fellow bankers to revise their charges to encourage the banking public to use plastic money and RTGS.

He added that Zimbabwe over-opened its economy when it dollarized in 2009 by allowing everyone to use foreign currency even for local services.

Guvamatanga said in light of the rampant abuse of the U.S dollar, the RBZ’s new policy measures are welcome.

“We need to find a means of transacting, a means of payment which doesn’t get abused. The U.S dollar as a means for local transactions has been abused and there is absolutely no way as an economy we can sustain it,” Guvamatanga said.

RBZ governor, John Mangudya, said it was good that some bankers supported his measures and would consider their proposals to lower the daily withdrawal limits and charges.

Despite the $1,000 daily withdrawal limits banks have set limits at between $200 and $400 due to the cash crunch.

Guvamatanga suggested a weekly $500 withdrawal limit.