Businesspeople and economists have in our last two editions of this three part series on Zimbabwe's economy expressed dissatisfaction over the central bank's proposal to introduce bond notes in an effort to promote exports and reduce the country's dependence on imports.

Members of the public are also worried about such policy measures being spearheaded by the Reserve Bank of Zimbabwe, which has a history of printing a worthless local currency.

Most Zimbabweans say the bond notes are reminding them of the country’s historic hyperinflation between 2000 and 2009 that left them penniless after the adoption of multiple currencies.

Tinomuda Zengeya is among millions of Zimbabweans, who don’t want to be reminded of the days when they used to carry large sums of money to buy just a loaf of bread.

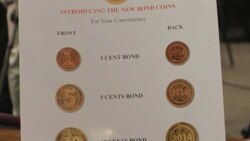

He believes that those days are about to return as central bank governor John Mangudya is planning to introduce some coupons, known as bond notes, in an attempt to revive the economy, now projected to grow by only 1.4 percent instead of the initial official rate of 2.7 percent.

Zengeya says the bond notes won't fix the ailing economy, including bank queues resulting from lack of cash.

“Government should address the economic challenges like exports. We are not exporting anything but importing everything,” he says.

Another Harare resident, Nqobizitha Mlambo, says the cash crisis is a signal that all is not well in Zimbabwe.

“The cash crisis is a reflection of a broader national crisis, a failure of governance, a failure of the government of President Mugabe whom we are now calling to do the noble thing and resign.”

Timothy Mugewa, concurs, stressing that Zimbabweans are losing confidence in President Mugabe’s government as there is no tangible proof that it may fix the ailing economy.

“When a government has failed, we the citizens lose trust in all the sectors of the economy and we do not even put money in the banks.”

Mugewa says instead of introducing bond notes to solve the current crisis, the Reserve Bank of Zimbabwe and the government should encourage locals to use plastic money.

“The private sectors must come and help through the use of plastic money whereby you use facilities like Ecocash and Visa cards because right now without cash we are going nowhere and this idea of bond notes will not help in anyway. It will actually worsen the situation as there will be no forex in the country. It is a symptom of a failed state.”

It still remains to be seen whether the central bank and government would pay attention to some of its citizens, who have been angered by moves to introduce bond notes to tackle the current cash crisis and ultimately fix the bleeding economy.